Paycheck bonus calculator

It can also be used to help fill steps 3 and 4 of a W-4 form. Bonus Calculator Percentage Method Primepay This calculator will help you to measure the impact that a.

What Are Marriage Penalties And Bonuses Tax Policy Center

Next divide this number from the.

. This bonus tax aggregate calculator uses your last paycheck amount to apply the correct withholding rates to special wage. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. See the Paycheck Tools your competitors are already using - Start Now.

Local income tax will not be charged regardless of the Texas state youre living or working in. How do I calculate hourly rate. Federal Salary Paycheck Calculator.

Like federal income taxes Minnesota income taxes are. It is perfect for small business especially those new to payroll processing. All calculators are automatically updated as payroll laws and tax tables change.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Get into your account. Ad Read reviews on the premier Paycheck Tools in the industry.

The Viventium Bonus Calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses. Netchex offers a robust collection of financial calculators that are free and easy-to-use. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms. A loan is a contract between a borrower and a lender in which the. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into.

Federal Bonus Tax Aggregate Calculator. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Free salary hourly and more paycheck calculators.

With this tax method the IRS taxes your bonus at a flat-rate of 25 percent whether you receive 5000 500 or 50 however if your bonus is more than 1 million the tax rate is 396. Get an accurate picture of the employees gross pay. Important Note on Calculator.

Or Select a state. Get an accurate picture of the employees gross pay. In Minnesota your employer will deduct money to put toward your state income taxes.

The payroll calculator from ADP is easy-to-use and FREE. Your Texas Paycheck Tax. Kenya Net Pay Calculator Calculate Gross Pay before PAYE Net Pay NHIF NSSF Deductions Ani Globe.

Bonus Pay Calculator Tool. It applies to anyone living or working in the state. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general.

Use this simple powerful tool whether your. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

Avanti Bonus Calculator

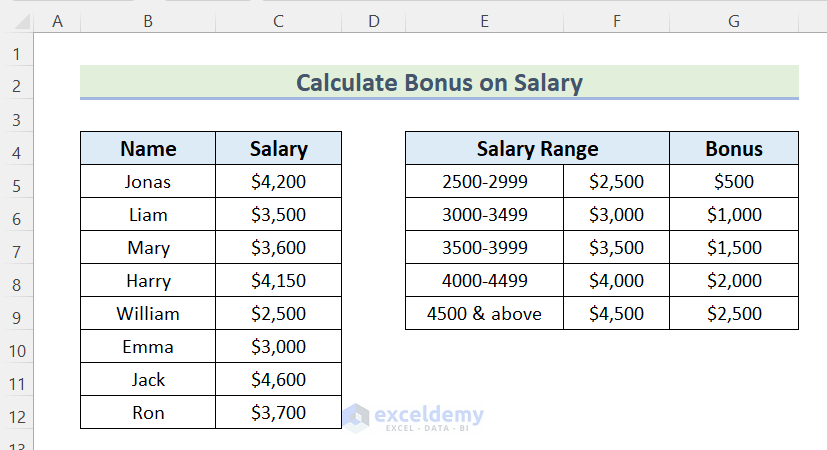

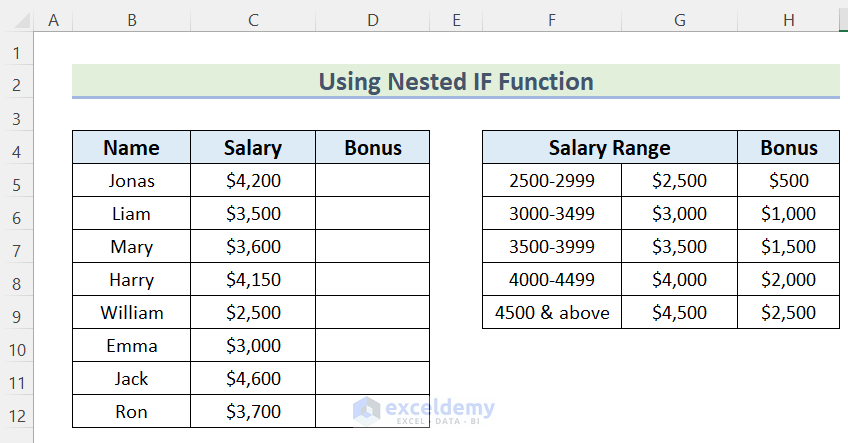

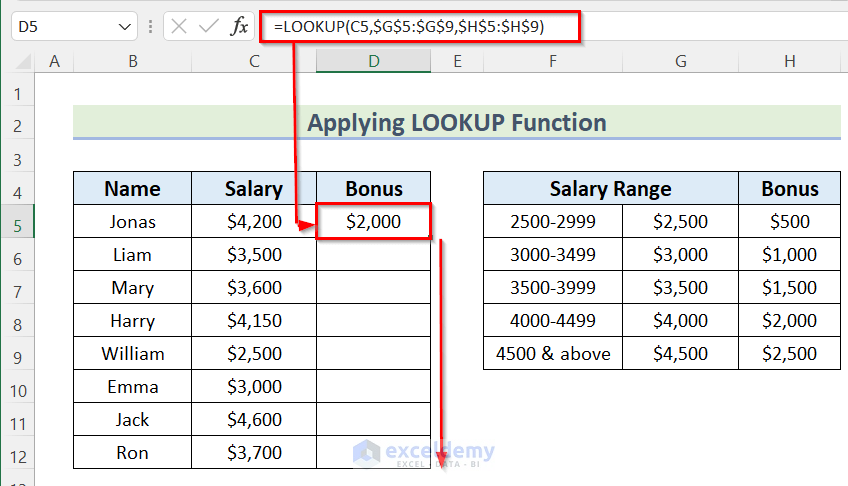

How To Calculate Bonus On Salary In Excel 7 Suitable Methods

How To Calculate Bonuses For Employees

How To Calculate Bonus On Salary In Excel 7 Suitable Methods

How Bonuses Are Taxed Calculator The Turbotax Blog

Bonus Calculator Percentage Method Primepay

How To Calculate A Bonus In Microsoft Excel Microsoft Office Wonderhowto

How To Calculate Bonuses For Employees In 2022 Recognize

Calculate Bonus In Excel Using If Function Youtube

How To Calculate Overtime When You Receive A Bonus Moss Bollinger

How Are Bonuses Taxed With Bonus Calculator Minafi

How Bonuses Are Taxed Calculator The Turbotax Blog

How To Calculate Bonus On Salary In Excel 7 Suitable Methods

Payroll Calculator Free Employee Payroll Template For Excel

How To Gross Up A Net Value Check

Avanti Bonus Calculator

4 Ways To Calculate Annual Salary Wikihow